While making large expenses and products affordable and you may within reach so you can the masses, loan providers will supply the customers the luxurious out-of breaking the individuals expenses towards quicker money quantity, otherwise because they are commonly titled EMIs. Let’s take a closer look on what is a keen EMI and you can how it try calculated.

What exactly is EMI?

When it comes to credit currency, the definition of EMI can be utilized. Full form out-of EMI are equated month-to-month instalment, and therefore refers to the repaired sum of money you to definitely a borrower have to pay back per month into the the financing. It consists of both the principal number additionally the notice energized to your mortgage. The brand new EMI, more often than not, stays lingering regarding the loan tenure unless of course there is certainly a big difference regarding the interest rate or even the payment terms and conditions.

Why does a keen EMI really works?

Equated Monthly Instalments (EMIs) try a familiar particular repaying financing. Brand new debtor pays a fixed amount monthly, consisting of both dominating and you will interest areas. Initial, a bigger section goes to your interest, for the dominating installment expanding slowly. The newest EMI remains lingering on loan period, simplifying cost management for borrowers. Lenders make use of the cutting balance means, recalculating appeal for the outstanding prominent. Very early EMIs lead far more towards the notice, if you find yourself later of them manage dominant payment. Facts EMI assists individuals plan money effortlessly and you may would their earnings, and make tall orders such as for instance house otherwise automobile so much more obtainable over time.

How EMI is computed?

An EMI includes a couple portion a portion of the dominating amount borrowed, and you can a portion of the full interest recharged towards the financing number.

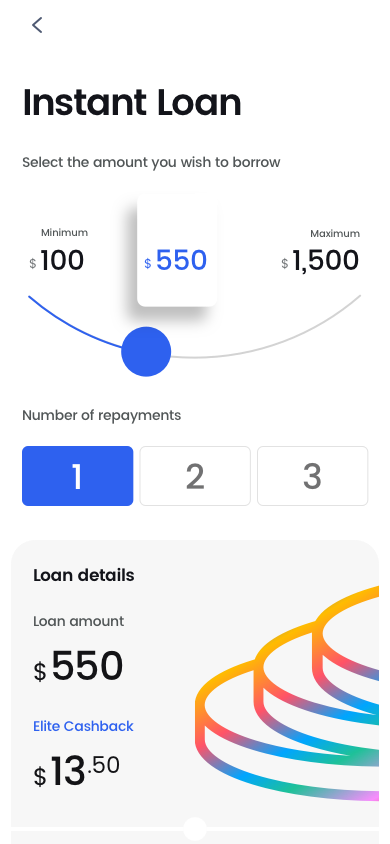

Calculating EMI will be cutting-edge and you can time intensive. Additionally, tips guide computation out of EMIs could lead to mistakes and certainly will features an adverse affect your money. To ease which tiresome activity, you need our very own mortgage EMI Calculator. Using this type of on the internet product, you only need to enter the amount borrowed you want, the present interest rate as well as the tenure in which you you would like the mortgage. The unit automatically really does the latest calculations and you can shows the fresh new you’ll be able to EMI towards the details entered.

Circumstances affecting EMIs

Multiple products influence Equated Monthly obligations (EMIs) into the fund. The main amount borrowed, interest, and you can mortgage tenure was no. 1 facts. Increased principal otherwise interest causes larger EMIs, when you find yourself longer tenures lead to smaller instalments, however, high total focus paid down. Credit scores and additionally play a crucial role; borrowers with straight down fico scores get deal with higher interest rates, increasing EMIs. Loan method of and cost regularity perception EMIs; fixed-rates finance offer predictable repayments, whenever you are varying pricing can also be fluctuate. At exactly the same time, prepayments or region-costs decrease EMIs of the decreasing the outstanding dominating. Skills this type of points support individuals do the finances effectively whenever availing fund.

Tips to decrease your consumer loan EMIs

Now that you recognize how unsecured loan EMI try determined. Here are some ideas that can help you in reducing your unsecured loan EMIs:

- Discover suitable tenure of your mortgage Deciding on the best loan tenure takes on a vital role in the efficiently dealing with the EMI payments. Choosing a longer stage minimises your monthly EMI but increases the entire notice costs. Striking a balance anywhere between both of these circumstances is crucial. People who have to prioritise all the way down monthly payments you are going to pick an extended repayment package, if you’re those planning to reduce attention expenditures might prefer a shorter tenure.

- Determine EMIs before you take out financing It is strongly suggested so you can do comprehensive calculations and you will carefully package your bank account, EMIs, and you may financing years prior to continuing to your application for the loan. We provide a personal loan EMI calculator that can help you to definitely conveniently estimate the monthly payments and you may rates. Which representative-amicable product is very easily available on all of our website and you will appear at the free of charge for you.

- Discuss the speed Getting into deals to reduce the eye rate will likely be a successful strategy for decreasing the month-to-month EMI money out of a personal loan. The speed actually impacts the credit cost, and you may protecting a lower rates is also notably slow down the overall installment number regarding the financing period. Moreover, a lowered EMI makes it possible to effectively control your month-to-month profit and reduce the general financial strain of the loan. You will need to lookup rates of interest and find an educated render and you can negotiate into selected bank to help you secure a beneficial interest.

- Generate prepayment Prepayment is the operate from paying a portion or perhaps the whole loan amount till the stop of one’s chose financing tenure. This action significantly reduces the newest the dominating balance and later reduces new monthly EMIs, putting some loan way more in balance. In addition, to make a much bigger advance payment advances your creditworthiness and you may boosts the likelihood of loan approval from the a lower interest. It is very important to help you carefully take a look at your debts and you may fees function prior to ount.

Bajaj Money Restricted has the benefit of consumer loan that have an optimum amount of Rs. 40 lakh, with a cost period as high as 96 months.

To generate advised behavior, we provide a consumer loan EMI calculator that enables you to guess your month-to-month EMIs ahead, letting you package your loan installment travels that have foresight.

Bajaj Finserv software for the financial requires and you can goals

Trusted from the fifty million+ users when you look at the Asia, Bajaj Finserv App try a single-stop services for the financial needs and you will goals.

- Apply for financing on the web, such as Instant Personal bank loan, Financial, Providers Mortgage, Silver Mortgage, and more.

- Explore thereby applying for co-labeled playing cards online.

- Spend money on fixed places and mutual money on new software.

- Pick multiple insurance rates for your health, motor plus pouch insurance policies, out of certain insurance agencies.

- Shell out and you will manage your debts and you can recharges utilizing the BBPS platform. Explore Bajaj Shell out and you may Bajaj Purse getting simple and quick currency transmits and you will purchases https://elitecashadvance.com/payday-loans-nm.