Scissortail Economic also provides USDA money when you look at the Tulsa having no down payment and you will aggressive costs. We are going to make it easier to navigate the method without difficulty.

What is a good Tulsa USDA Mortgage?

A beneficial Tulsa USDA mortgage try a specialist mortgage system designed to let reduced- to moderate-money families from inside the to order belongings situated in eligible outlying and you can residential district areas. Supported by the usa Institution from Farming (USDA), this type of financing give several distinct pros, and make homeownership a lot more obtainable for those who qualify.

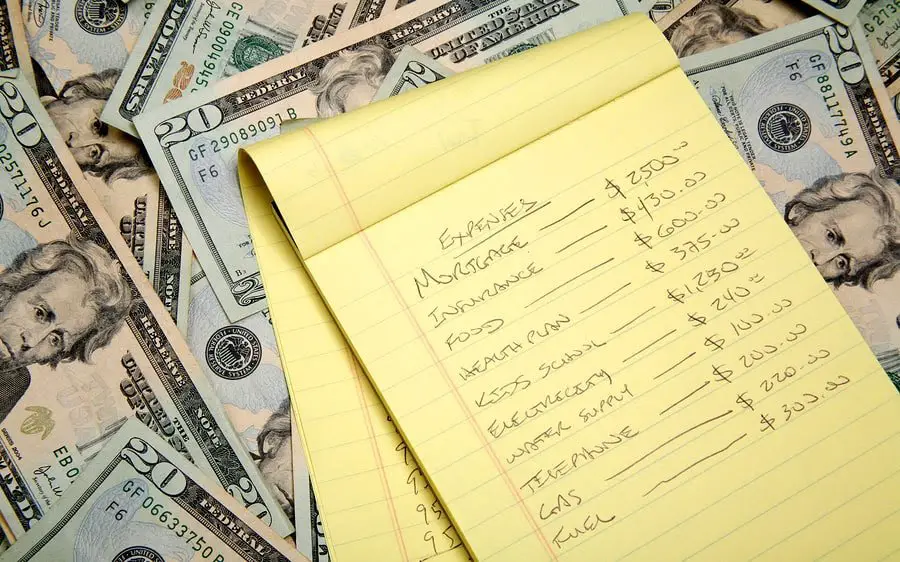

No Deposit: One of the several benefits of an effective USDA financing is actually as possible funds around 100% of your own residence’s purchase price, reducing the necessity for a down-payment. This particular feature helps make homeownership a whole lot more doable for almost all buyers who will get n’t have large savings to own a timeless advance payment.

Lowest Home loan Insurance coverage: The borrowed funds insurance fees of USDA financing are often down as opposed to those to own FHA otherwise traditional money. This helps to keep monthly installments manageable and reduces the full cost of credit.

Flexible Borrowing Requirements: USDA fund offer a whole lot more lenient borrowing conditions than the a number of other loan types. So it liberty can make it easier for consumers having faster-than-finest borrowing from the bank so you’re able to qualify for a home loan.

Geographical and Earnings Constraints: In order to be eligible for an effective USDA loan, the house or property should be based in a qualified rural or suburban urban area as laid out by USDA. Concurrently, people have to meet specific income standards, which happen to be generally speaking in accordance with the average earnings towards city and you may adjusted getting house dimensions.

Total, a USDA mortgage should be ideal for being qualified homebuyers within the Tulsa who are looking to purchase a property from inside the a great rural or suburban means if you’re taking advantage of positive loan terms.

Tulsa USDA Financing Conditions

To qualify for a great USDA financing for the Tulsa, consumers must meet multiple key standards dependent by USDA and you may private lenders. installment loan Riverside Here is what you have to know:

Earnings Restrictions: Your income need certainly to slip for the USDA’s appointed limits to suit your area and you can friends size. This type of constraints are created to make sure the system facilitate lowest- to help you reasonable-money families.

Credit score: At least credit rating of around 640 could be popular. While the USDA doesn’t put a strict lowest, loan providers possess their own conditions.

Primary Residence: The house you are to purchase is employed as your no. 1 household. USDA money are not available for capital qualities or 2nd residential property.

Property Qualification: The house must be based in an eligible outlying otherwise suburban area while the outlined because of the USDA. Metropolitan characteristics are not eligible for USDA financial support.

Debt-to-Income Ratio (DTI): Generally speaking, an effective DTI proportion from 41% or quicker is recommended. That it ratio tips the complete monthly obligations payments facing your own disgusting monthly money.

A career History: Loan providers always want at the very least couple of years off consistent a job. So it reveals balance while the capacity to carry out home loan repayments.

Fulfilling these standards helps you take advantage of the positives given by USDA loans, including zero advance payment and you may competitive interest levels.

Tulsa USDA Financing Earnings Restrictions

For 2024, brand new USDA has generated specific money limitations to have being qualified for a beneficial USDA loan when you look at the Tulsa, highlighting a growth throughout the past season. These types of limits ensure that the program pros lowest- so you can average-income homes. Here are the upgraded earnings constraints:

House of 1cuatro Somebody: The money restriction is decided in the $112,450. That it means a rise regarding the past year’s restriction out-of $110,650.

This type of money thresholds are created to match various family members systems and earnings accounts, and then make homeownership significantly more accessible having a wide list of individuals. Appointment these constraints is extremely important to help you be eligible for an effective USDA financing, which supplies advantages such as for example no deposit and you may aggressive focus cost.