Creating an extensive economic studies of the debtor is considered the most area of the responsibilities out-of a home loan strategy

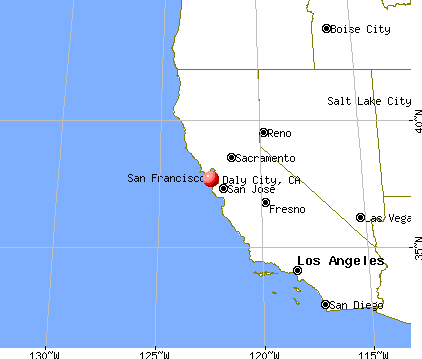

A major flipping area, buying property, need meticulous believe, economic readiness, and-above all-appropriate capital options. With no guidance away from an experienced mortgage arranger, the whole process of acquiring a property mortgage are going to be state-of-the-art and you may taxing from inside the San diego. Examining their loans, advantages they provide, and just how it permit a flawless family-buying procedure, this web site discusses this new vital status a hillcrest mortgage arranger performs. Understanding the key from property mortgage plan support potential homebuyers in order to with full confidence discuss the brand new difficulty away from household loans.

Our home Financing Pro North park can be found to provide constant service no credit check personal loans Kingston OK in the event it involves terms of the loan or closure techniques

For the Hillcrest, the spot where the realtor industry is aggressive and you can bright, the info out-of a property loan strategy will get crucial. Their comprehensive focus on several mortgage products, interest levels, and you will application methods guarantees you to readers rating custom pointers fit for their financial predicament.

This can include examining the newest buyer’s money, credit history, functions records, and you can current loans weight. Understanding these economic points support the house Mortgage company North park elite to suggest loan choices that fit brand new borrower’s problem. So it designed method promises the debtor will not overindulge economically and you may improves the likelihood of mortgage acceptance.

Regarding conventional money to help you regulators-supported loans such as for instance FHA and you can Va loans, the newest Hillcrest A home loan Choice surface gift ideas a good rainbow of funding alternatives. By offering the fresh debtor the absolute most simple choice, an experienced mortgage arranger streamlines which complexity. It break out this new nuances of any loan kind, together with qualifications conditions, rates, and you will regards to pay. Which thorough suggestions support the newest borrower to decide a loan you to definitely most closely fits their requirements and you may a lot of time-label economic expectations as informed alternatives.

A home loan application will be intimidating because it demands cautious recognition techniques and the majority of documents. Simplifying this step mostly utilizes a san diego family mortgage arranger. It assist users properly done application forms, secure the desired records, and submit them to the lender. Their degree guarantees that every documents is finished and you may conformable that have bank requirements, thus speeding up this new recognition procedure.

Another important role regarding home financing plan is negotiating top mortgage conditions. Their community education and relationships with different lenders assist them to to help you negotiate for the brand new debtor to acquire realistic interest levels and flexible repay episodes. It settling expertise can result in large savings across the financing existence, so and make homeownership even more low-priced towards the buyers.

A home loan arranger suits motives outside just financing approval. They answer questions the debtor may have and offer constant assist all through the house-to acquire process. So it continuous guidance claims that the debtor remains convinced and you may educated inside their solutions.

The true estate industry regarding San diego keeps certain unique attributes and tendencies. Local expertise in home financing arrangement contributes excellent value. He’s conversant on the regional property opinions, homes ics off neighborhoods. This regional knowledge makes it possible for promote customized recommendations fit for the particular conditions and you can preferences of your debtor. Its existing links to help you regional real estate professionals and you will loan providers along with help simplicity the acquisition procedure.

Let’s comment certain victory tales to exhibit the value of a great home loan arranger. Imagine an initial-time homebuyer whoever absolutely nothing credit history overwhelms the borrowed funds software process. They enhanced the credit standing, negotiated mortgage possibilities with the aid of home financing arranger, last but most certainly not least received an FHA loan that have a good standards. One other for example is a seasoned Hillcrest consumer off a home. Leverage their ability to track down a zero-deposit loan, the home loan arranger helped all of them from the Va loan processes, ergo enabling homeownership.

You’ll find troubles along the way to locate a home loan. Normal obstacles try higher borrowing from the bank prices, rigorous credit standards, and difficult documents procedures. Giving strategic the advice and you will achievable solutions, home financing arranger can help you overcome this type of barriers. They help consumers make certain all of the records are exact and you can done, explore other credit possibilities, and you can increase its credit scores. The proactive approach considerably raises the likelihood of mortgage acceptance.

Aside from individual purchases, financial organizers influence society significantly more fundamentally. Support regarding homeownership helps ensure your neighborhood cost savings is stable and you can grows. Among social and you may monetary benefits related to homeownership was even more civic involvement, finest instructional performance, and much more cohesiveness off communities. And make such advantages accessible to far more San diego citizens would depend critically to the a committed home loan arranger.

An essential basic stage in your house-to order techniques try selecting the compatible financial bargain. Possible consumers will be give thought to aspects in addition to sense, character, and you can customer endorsements. An experienced Hillcrest house mortgage specialist having a reputation winning purchases and happier people is likely planning to send earliest-rate medication. In addition, crucial faculties from home financing arranger was unlock interaction and a consumer-centric thinking.