What’s a residential property?

A residential property try a home that isn’t most of your quarters, and that you purchase on the purpose to generate local rental income otherwise sell for funds.

Mostly, they truly are one to- in order to four-tool leasing residential property otherwise households you buy to resolve and you will flip. Toward purposes of this short article, we’re not and industrial money features eg apartments or place of work buildings.

It is critical to separate anywhere between financial support features and you can next home because home loan regulations and you will rates differ for every particular property. The largest difference in the 2 is you need certainly to take the next home for around area of the seasons, whilst you – the owner – don’t reside in a residential property.

An additional domestic or vacation home you are going to amount once the a type away from investment property if you intend to rent it out even to possess short periods. not, financial policies will vary more that it.

Particularly, Fannie mae enables you to rent a moment domestic provided you occupy it oneself to have a period of time annually, retain exclusive power over our home, plus don’t have confidence in their expected rental income after you implement. Lenders might expect an extra the place to find be in a beneficial site visitors area for a vacation household or a certain distance out-of your primary house if you intend to use it once the an enthusiastic occasional house.

Money spent mortgage selection

Most of those individuals seeking to investment property fund will require antique mortgages. The majority of these are conforming mortgage loans,’ definition they comply with credit laws and regulations lay from the payday loan Bridgewater Fannie mae and you may Freddie Mac computer. (Details lower than.)

Its a condition of all government-supported mortgage loans (FHA, Va, and USDA loans) that borrower occupies our home as his or her no. 1 house. Very speaking of bad source to own money spent fund.

But not, there was one difference. You can use a national-backed FHA or Va financing to purchase a great multifamily hold with a couple, three, otherwise five tools. And you may, given you live in one particular, you might rent another(s).

Different ways to invest in a residential property

- Family collateral: A property collateral loan or home guarantee credit line (HELOC) on your own latest home

- Personal financing: Home people tend to often financing a purchase of rental property

- Seller capital: From time to time, a vendor the master of a home downright can get trading the newest swelling share she’d normally discover to have a continuous income weight

- Hard money money: This type of short-name funds can sometimes work well having family flippers looking to grow its resource portfolio

But most to invest in funding attributes seek out main-stream lenders, and additionally finance companies. Discover particular by way of our very own web site using the Request an excellent Price service. You can easily in the future look for a question you to asks if or not you desire the fresh mortgage for investment objectives.

New investment property loan procedure

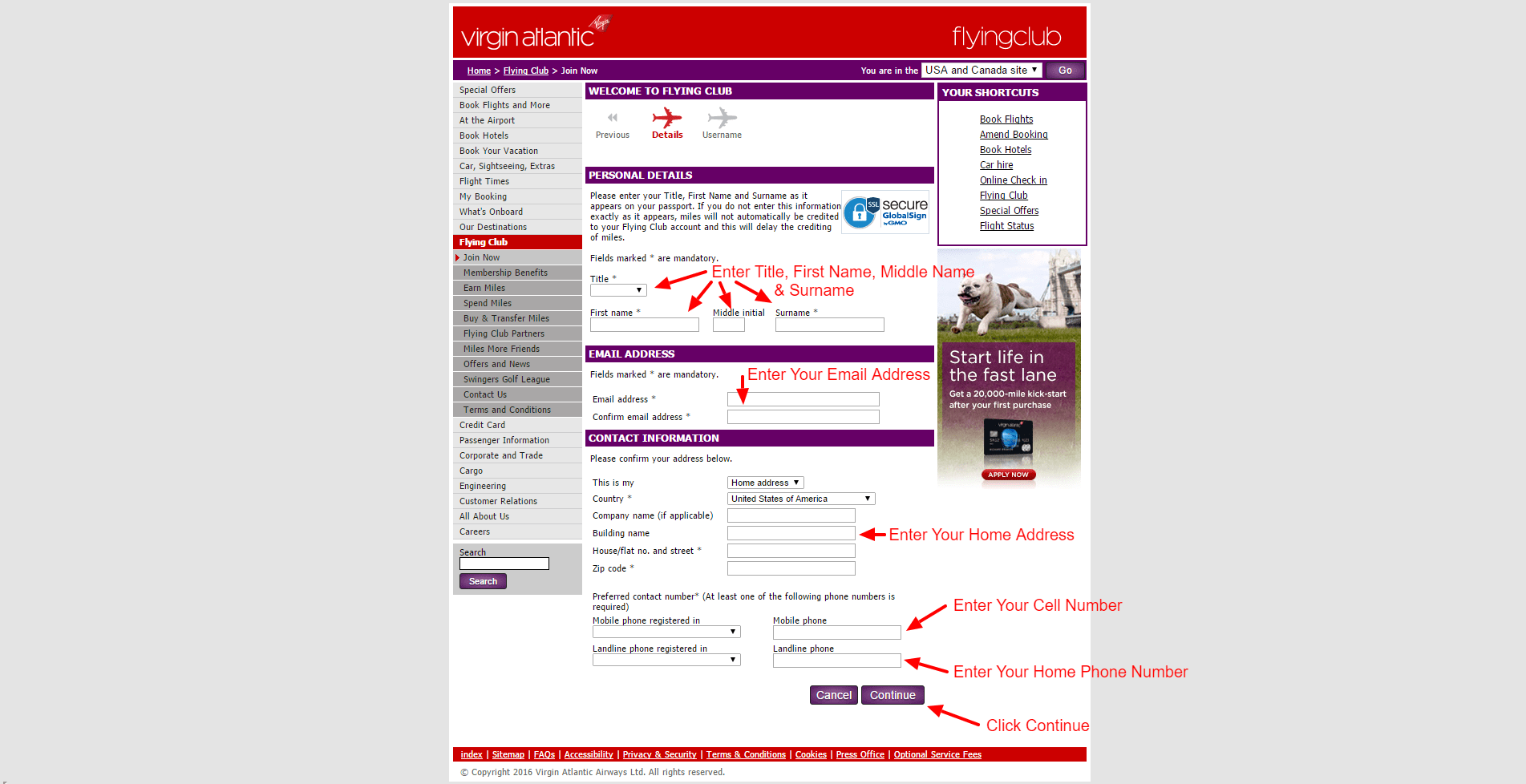

If you intend to finance forget the assets having a conventional financial (probably a conforming financing), the borrowed funds processes look very similar to other family buy. You’ll:

- Rating preapproved for money

- Select a house and work out an offer

- Submit an application for the loan

- Secure mortgage loan

- Look at the underwriting process

- Sign last papers to your closing time

Given that when selecting property for your self, it is better to locate preapproved for a home loan ahead of you start family query. That way, you should understand exactly how much family you really can afford. And you may, even more important, owner and you will seller’s real estate professional will know you’re making a serious bring.

Before you can decide on a lender, make sure you research rates for the right investment property home loan rates there are to possess investment money. Understand that money spent mortgage cost usually are 0.50 so you can 0.75% (both 0.875%) greater than those individuals having fundamental mortgages. And reduce your mortgage speed, the higher your own profit percentage for the assets could well be.