Your own credit card use tends to make or split their mortgage loan acceptance. Lenders research not just at the credit history in addition to at your debt-to-money proportion, with the brand new payments on your playing cards. Therefore poor access to your own playing cards will make they more complicated to find acknowledged to have a mortgage.

Given that credit cards is actually revolving financial obligation, you may have constant usage of the credit contours, that place your lending company at stake whether or not it will get out of hand. Here’s what lenders want you to learn about mastercard use to improve your odds of mortgage recognition.

step one. Dont Carry a balance

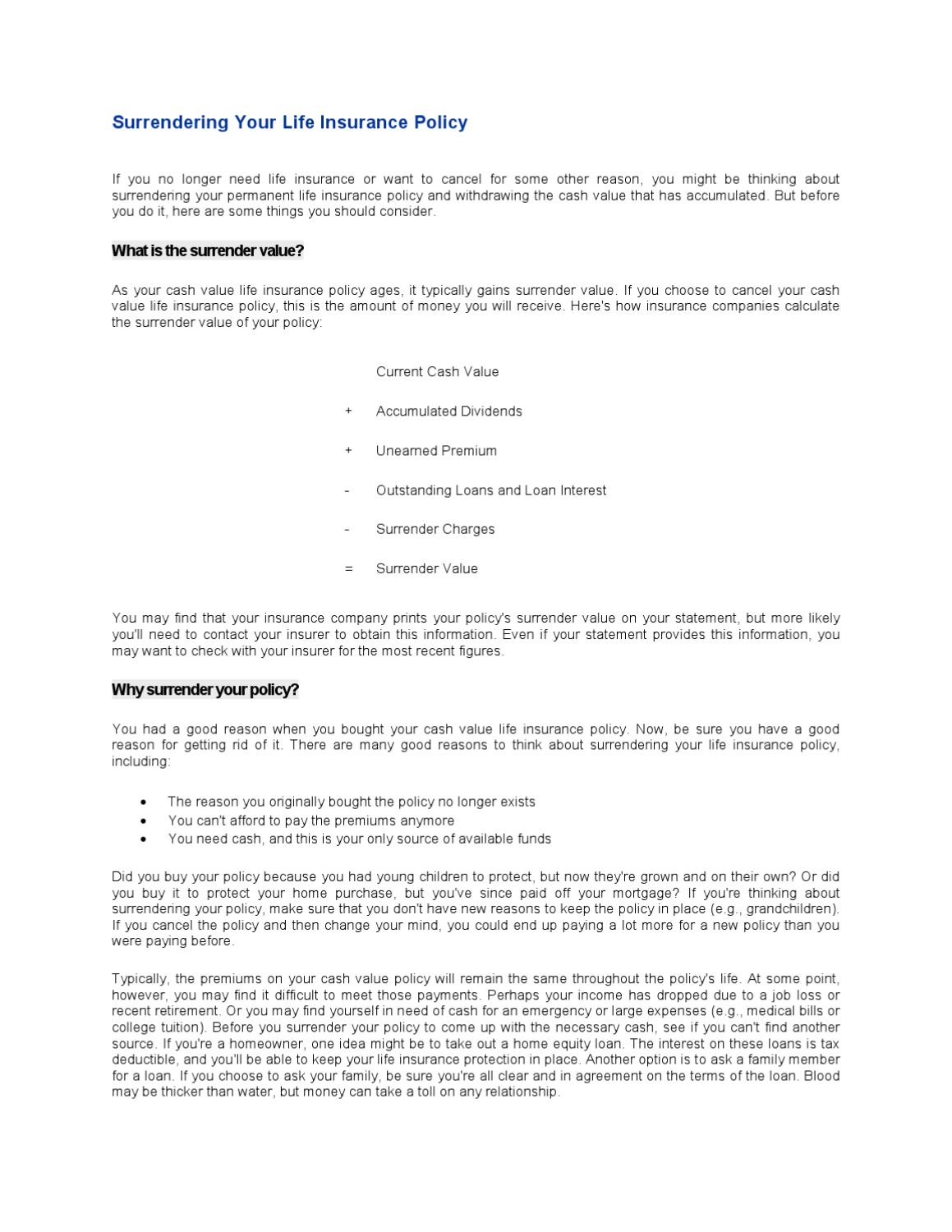

Holding a credit card balance will set you back you more cash since harmony accrues appeal. Extremely creditors fees everyday attention, so your harmony develops every single day until you pay it back.

Carrying credit cards balance as well as signifies that make use of their bank card getting instructions other than what you are able manage. In case the harmony is actually higher compared to their credit limit, it influences your own borrowing from the bank utilization speed and you may credit history.

Thus not merely really does holding a charge card equilibrium charge you more eventually, but inaddition it gives lenders a description to trust you’re not economically in charge.

This doesn’t mean you won’t become approved if you have any mastercard balance. not, you should keep your own credit card balance in this what you are able pay-off per month whenever possible to cope with your money and you can to display lenders that you’re a reasonable exposure once you sign up for a mortgage.

Exactly what Loan providers Would like you Knowing

Merely costs that which you learn you could pay one to day. For many who need certainly to charges something you can’t pay in full, build over minimal fee. Such, when your heating system holidays while can not afford to spend it of in full, split the bill into 2 or three payments making it less costly when you find yourself paying the harmony from quickly.

dos. Avoid using Your own Handmade cards due to the fact an extension of your own Earnings

Credit cards are not an invite to invest what you need. Lenders nonetheless want you to adhere to a spending plan. By using credit cards as the an extension of your own money, you find https://paydayloancolorado.net/victor/ yourself in the personal credit card debt.

Not simply will it echo defectively when you yourself have much out-of credit debt, but it also expands the debt-to-income proportion. Per loan system keeps a max DTI they are going to ensure it is. The DTI is sold with all monthly payments in your credit report, including your minimum bank card payment. Way too much financial obligation increases your own DTI making your ineligible to possess an interest rate.

Just what Lenders Want you To know

If you cannot pay for a buy, cover it. Unless its an emergency, try not to fees they if you don’t have the cash to expend it well. Instead, find out a cost savings plan so you’re able to shell out bucks for the thing and never put yourself next to the loans.

Once you get a mortgage, loan providers determine the debt-to-income ratio. If your DTI was high as you create way too many commands, it might charge you mortgage acceptance.

step 3. View your own Bank card Usage

Your charge card utilization actions your own complete credit card debt once the a percentage of one’s credit limit. Instance, for those who have good $step 1,000 borrowing limit and you can a good $500 mastercard balance, you may have a good 50% borrowing from the bank use rate.

Your credit rating decrease if for example the borrowing usage rates increases past specific restrictions that disagree by the borrowing from the bank bureau plus the collection from people who your get into (titled a scorecard). Such, guess you’re in a specific subset off people who is actually punished in the event the the application is 31% or more on one of your own credit bureaus, game to the nearest fee section. For each $step 1,000 on your personal line of credit, don’t have more than simply $295 a fantastic. This doesn’t mean you can not make use of charge card, nevertheless should simply charges what you are able be able to remain your balance reduced.