After you get a loan, the potential financial tend to consider their likelihood of repaying what they’ve been lending to you personally. They’re going to work with monitors in your creditworthiness and you can using activities to gauge your financial profile and and thus determine whether you’re likely to create your own financial and you may pay-off them in full.

Might check your borrowing and you may installment history, examining playing cards, overdrafts, hire purchase plans, car loans, unsecured loans, mortgage loans, and stamina, liquid, gas and you may mobile expenses. It argue that the manner in which you do quick obligations is an indicator out of how you would create a big financing.

Credit inspections

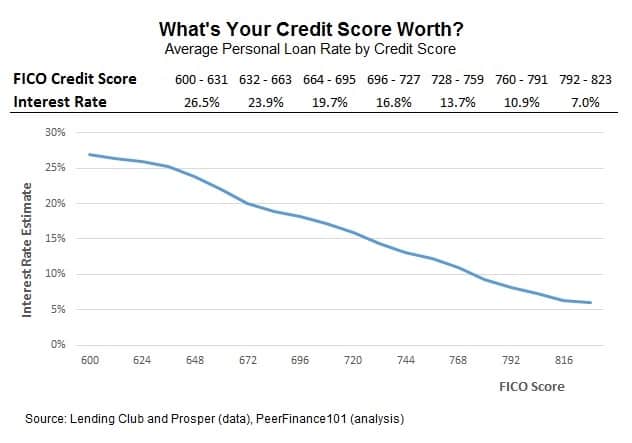

A possible financial is going to run a credit assessment you and may come back with a get between zero and you can good thousand. A get less than five hundred and you may find it hard to be considered having a mortgage. five-hundred so you’re able to 700 is regarded as the common chance, and you can people get more 700 could be better-considered.

What influences credit ratings?

Credit history: For example the account, particularly playing cards, unsecured loans, or mortgages. A long reputation of in charge borrowing fool around with is going to be a positive to suit your credit score. An excellent expense: A great amount San Acacio loans of outstanding costs adversely affect your credit rating given that it indicates a higher rate from bills. Percentage records: A out-of if you made repayments on time, which includes costs. Later or skipped repayments can be damage your credit score. Credit utilisation: Here is the number of credit you are using versus the level of borrowing from the bank available to you. Using a premier part of the available borrowing might have a great negative effect on your credit score. Constant borrowing from the bank checks: Borrowing from the bank concerns to possess loan applications make a difference your credit score. For each credit score assessment try submitted on your credit history. Several credit monitors when you look at the a short period are translated because your seeking an abundance of borrowing from the bank or feeling financial difficulties. Address change: A steady residential target checklist will help your credit rating. Bankruptcy: Most recent otherwise early in the day insolvency in your document can be regarded as a beneficial solid sign of credit exposure.

Handmade cards

Whenever banking companies consider how you will provider their home loan, they’ll also consider the level of financial obligation you could potentially have, not only the degree of loans you have. Put another way, playing cards connect with your ability so you’re able to borrow on a home loan since the banking institutions will during the facts you could potentially undertake a great deal more financial obligation. Then they will work into presumption you will tray up as much personal debt as your cards can help you. Hence, the lower their credit card limit, more you could potentially borrow.

Charge card limitations

So you’re able to a lender, playing cards is an accountability while they need believe one to you could potentially draw down on the full matter any kind of time area. Your, as well, can get view increased limitation on the charge card while the a great handy merely into the case’. Thus be mindful, which have you to definitely more income offered might end up charging your dearly in terms of obtaining home financing.

If you have the put for a home but they are struggling so you can obtain enough, your own credit card limit may be the determining reason behind financial recognition. Cutting your restriction away from $20,000 to help you $5,000 you certainly will mean having the ability to obtain an additional $65,000.

As to why? Due to the fact banks glance at future potential credit debt whenever figuring serviceability. For those who borrow on your mastercard, under the bank’s calculations there are even less earnings available to go to your mortgage. If you decided to fall behind on obligations, you will be prone to focus on paying down credit cards personal debt for the highest interest levels and you may and thus getting your home mortgage repayments at stake.