On this page

- What exactly is a leave means?

- Mortgage brokers getting age pensioners – is it feasible?

- Government-work on schemes

- Open equity on the present household

- Extremely lenders would like to select an exit strategy i.elizabeth. the manner in which you will pay for the mortgage once you turn 50. Of many lenders likewise have an arduous limit out of eligible people as much as 80 years of age.

- This your retirement might possibly be analyzed as income, but won’t be enough.

- If you currently individual property outright and you’re trying to purchase an alternate, individuals household guarantee schemes including the Home Equity Availability Strategy, family equity finance and you will reverse mortgage loans you can expect to number on money criteria.

- There are even relaxed pension criteria and you may stamp obligations exemptions having those individuals trying to downsize their home.

- Its imperative your consult with a monetary adviser otherwise taxation elite to ascertain how to funds a home purchase in your old age, especially instead hurting pension eligibility.

For the typical home buying point in time, say the later twenties otherwise very early 30s, you connect with the financial institution with your put, payslips, and you will a beneficial offers record, and you are clearly usually on your own merry way. Considering really financial terms and conditions are 25 otherwise three decades this makes it possible for young individuals to repay it totally in advance of retirement age.

Although not let’s say you might be approaching old-age? The financial institution is just about to like to see just how you’ll shell out out-of a home loan. Very, the latest path of having a home loan becomes a bit more difficult, no matter if you built up a good amount of wide range. Due to the fact dated stating happens, elderly people or retired people are usually advantage steeped, bucks poor’. To get home financing you will need to prove the method that you can pay it well, score imaginative, or have fun with some plans in your favor.

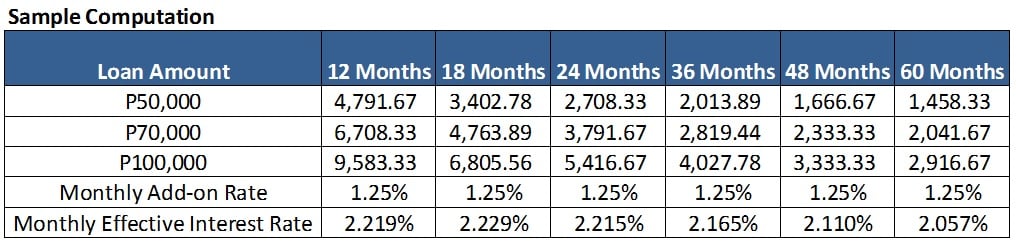

Feet criteria of: an effective $eight hundred,000 amount borrowed, varying, repaired, principal and you may desire (P&I) payments. Every affairs with a relationship to something provider’s site provides a professional revenue relationships anywhere between us and these providers. These things may seem prominently and first within the research tables aside from its functions that will tend to be affairs noted given that promoted, checked otherwise backed. The link to something provider’s web site makes it possible to learn more or apply for the product. From the de–trying to find Inform you on the web people only a lot more non-commercialised points could be exhibited and lso are-arranged on top of the new dining table. To learn more about exactly how we chosen these Sponsored, Featured and you may Promoted bad credit personal loans Indiana affairs, the items i evaluate, how exactly we benefit, and other important information regarding the our very own services, excite view here.

Month-to-month fees figures was estimates only, prohibit charges and are based on the said price for a 30 season term and for the amount borrowed inserted. Genuine costs hinges on your individual points and you may interest alter. To have Notice only money new monthly cost shape is applicable just for the eye only months. Following the appeal merely months, their dominating and you may appeal repayments might possibly be more than these types of money. To have Fixed speed money this new month-to-month payment is based on mortgage loan you to enforce having a primary months merely and will change in the event the interest speed reverts towards appropriate variable price.

Mortgage brokers to possess Seniors

The brand new Investigations rates is dependent on a guaranteed loan amount away from $150,000 loan more than 25 years. WARNING: Such assessment rates incorporate merely to the latest example otherwise instances considering. Additional numbers and you may conditions will result in some other testing pricing. Can cost you such as for example redraw costs or early installment charge in addition to will cost you offers such as for example percentage waivers, aren’t as part of the review rate but can influence the fresh cost of the latest loanparison prices aren’t determined having rotating borrowing situations. Prices best at the time of . Look at disclaimer.