Who’ll Discover an excellent Roth IRA?

Are eligible to unlock an excellent Roth IRA, you’ll want generated earnings. The internal Funds Solution represent nonexempt money and earnings since the currency made from an effective W-dos jobs otherwise thinking-a position such as for instance childcare team or babysitting.

Among the advantages of Roth IRAs was there isn’t any years limitation towards the account citizens. To put it differently, should your child performed some babysitting year round and gained $five-hundred, they are able to contribute one to entire amount to a great Roth IRA significantly less than the name. Yet not, if for example the youngster try younger than 18 (otherwise elderly, with respect to the county) the fresh mother/protector should start the new membership just like the a custodian.

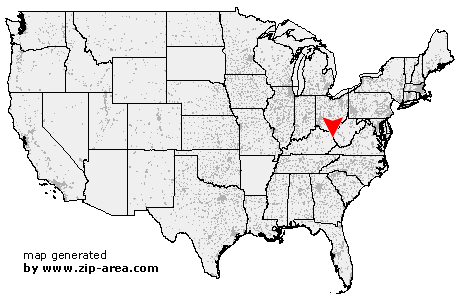

You could potentially open a beneficial Custodial Roth IRA otherwise Custodial Antique IRA getting a baby, and once he/she has reached the age of vast installment loans in AK majority, usually 18 or twenty one, all possessions and liberties would be transitioned in it.

When you are in search of beginning a beneficial Roth IRA for yourself or an established, you might realize these types of step-by-step recommendations to do this.

Roth IRAs provide book taxation advantageous assets to customers. But not, the latest Internal revenue service simply enable you to make the most of those people professionals when your altered adjusted gross income (MAGI) is within certain thresholds.

The latest MAGI endurance may differ because of the season. Into the 2023 income tax 12 months, you can contribute the maximum you’ll be able to amount to a great Roth IRA if you make below $138,000 a-year because a single individual or less than $218,000 given that partnered taxpayers.

When you find yourself below these types of thresholds, your meet the earnings qualification conditions. While significantly more than all of them, your ount in order to an excellent Roth IRA, your maximum sum have a tendency to reduce since your income go upwards.

2. Determine where you can discover your own Roth IRA

Once you’ve concluded that you meet with the money standards to make use of so it resource method, the next step are figuring out the best places to open this new capital membership. Very financial institutions provide Roth IRAs to possess money management. The best choice get only be to open up one of them variety of profile at your latest lender making it effortless in order to import funds on account.

Something you need to know on taxation-deferred account for example Roth IRAs is the fact they’ve been highly managed by the us government. It means you’ll find scarcely meaningful differences between Roth IRAs considering by additional banks.

1st action try ensuring your favorite bank are FDIC-certified in advance of setting up a Roth IRA conversion process. Otherwise, your own fund could well be at stake when your lender goes wrong. Similarly, be sure your own brokerage try covered by Securities Buyer Defense Business (SIPC).

3. Assemble the desired recommendations

Now you are happy to initiate gathering everything you ought to setup their Roth IRA. Here’s certain information your own lender might ask for when you unlock an account:

- A license otherwise the same version of character

- Social Defense amount

- A position suggestions

- Title, address and you can Personal Safety quantity of beneficiaries

- The bank’s navigation number and you will examining otherwise discounts profile

4. Like your own assets

Your own Roth IRA is not just to possess spending less. In addition doubles because the a broker account you need to use so you can make investments one secure income tax-deferred income for your requirements. Also, it is a good idea to consult a monetary advisor whenever you are discovering an investment means. But you’ll be free to put money into many kinds off property, including:

- Mutual fund

- ETFs

- Private equities

- Bonds

When making an investment means, it’s essential to think about your age and you will whether or not you’ve got any big-solution costs approaching, particularly a property purchase, which will impact your ideal investment possibilities. Speaking with a monetary and income tax coach will allow you to create the best decision to suit your situation.