Individuals should be encouraged to proceed because guidelines; the most effective danger would be the fact individuals will offer right up hope or panic and you may sometimes walk away from their functions otherwise use the legal program in order to prevent whatever they believe becoming inescapable foreclosures. When a borrower’s delinquency runs early in the day go out 90, the newest servicer must go from delinquency management to losings minimization. Once 3 months out of mortgage delinquency, the organization affect the financing exposure faces a possible for most types of loss, and you can foreclosures on relevant property administration and final sale, is the most pricey alternative. Losings mitigation setting interested in some solution lacking property foreclosure. Such resolutions are typically titled mortgage working out. Minimum of high priced work out options are people who keep consumers within the their homes, as well as the next top are the ones and help borrowers in enabling from the now burdensome economic obligations out of homeownership within the an excellent a lot more dignified and less expensive trends than simply property foreclosure.

The choice useful people which have it’s temporary, one-date troubles is the advance allege. In this case the fresh insurance company will pay this new servicer the degree of the latest delinquency in exchange for a promissory note about debtor. The borrowed funds loan will be made entire, in addition to insurance company normally gather area or most of the get better from the borrower over the years.

This will be rewarding if your home loan carries a below-business interest that would make their business more desirable, plus instances where in actuality the expectation it allows the purchaser in order to receive a higher financing-to-worthy of proportion than you’ll if not become hit

The following selection for staying consumers with short-term troubles in their belongings are an effective forbearance package. This is used having borrowers who possess brief decrease when you look at the income but have a lot of time-label applicants to own develops for www.paydayloanalabama.com/talladega-springs/ the earnings which will again sustain the fresh home loan personal debt. It is reasonably utilized whenever troubled individuals are working to offer attributes by themselves. The forbearance period normally expand out of six so you’re able to 18 months otherwise expanded, according to the borrower’s circumstances. During this time period individuals can be first permitted to create quicker monthly obligations, attempting to take away the delinquency by way of enhanced costs in the second part of the forbearance several months. As insurers, Fannie mae, and Freddie Mac typically envision forbearance preparations an effective servicer number, he or she is unusual used, leading some residents to get rid of their houses needlessly.

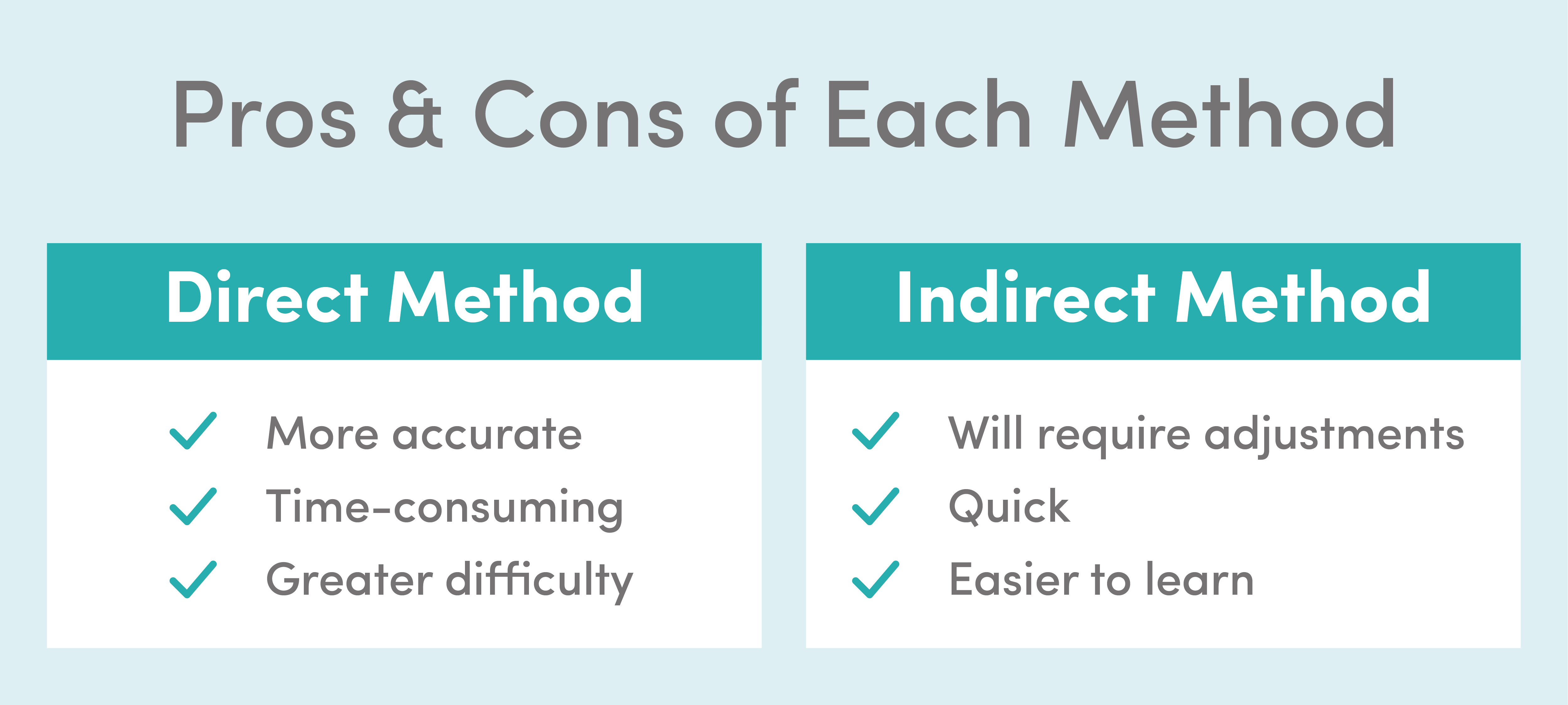

Having permanent reductions inside the income, the only way to let stressed borrowers to keep their house is with loan modification

Financing data files will be modified at all, but the a few most typical is actually focus-speed decrease and label extensions. Loans with more than-markets interest levels will likely be refinanced to the business rate and you may consumers energized almost any part of the practical origination percentage they are able to afford. Should your interest rate is already at the otherwise underneath the most recent rates, up coming monthly obligations are going to be permanently shorter from the stretching the expression of mortgage, also performing an alternate 31-year amortization schedule.

Such as for instance variations you could do easily and you may inexpensively for funds kept into the portfolio, as well as in the past few years they have feel more straightforward to pertain to possess the individuals money into the mortgage-backed cover (MBS) pools. Federal national mortgage association therefore the You.S. Institution from Veterans Factors easily agree to enable it to be servicers to shop for qualifying money regarding MBS swimming pools, customize all of them, immediately after which sell them back into this new company to hang into the a retained profile. Freddie Mac, that has a protection design distinct from that Fannie mae, really works the purchase by itself adopting the servicer completes transactions on debtor.

In some instances consumers be more effective off getting away from their current house. There is certainly a want to see a career elsewhere, a divorce settlement that requires selling the home, decreases in the income that demand thinking of moving less expensive housing, otherwise a dead debtor having a home are liquidated. Regardless of the need, there are three choice on the market today having individuals just who have to bring up their homes. The very first is promoting our home with that loan expectation. Credit agencies commonly waive the owed-on-revenue term out of fixed-speed financial deals as needed to help troubled consumers sell their properties and get away from property foreclosure.